Are you thinking about buying a new rental property? If so, calculating cash on cash return is a critical part in analyzing if a rental is going to be a good investment or not.

How to Calculate Cash-on-Cash Return

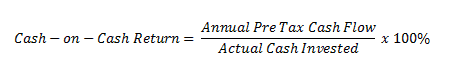

Calculating cash-on-cash return is simple. We simply divide the received net cash flow for the year by the amount of cash invested.

Not too bad, right? However, it’s the variable—annual pre-tax cash flow and actual cash invested—that can be tricky.

Understanding annual pre-tax cash flow

Calculate your annual pre-tax cash by adding together:

- Gross scheduled rent: The property’s gross rents, multiplied by 12. This reflects the maximum amount of income you can expect to receive.

- Any other income: Think about all of the other earning opportunities the property may present. Will you allow pets and receive pet income and non-refundable deposits? Do you have parking spaces available? Do you get reimbursed for utilities or charge a flat rate regarding such?

Then, subtract:

- Actual vacancy: If you already own the property and you are wanting to produce the cash-on-cash return to understand your property’s performance, you will want to use actual vacancy here. The actual vacancy should be measured by the numbers of days your property was vacant multiplied the daily rental rate. Otherwise, use potential vacancy—which should always be a conservative number. Multiply your vacancy rate by the gross scheduled rent.

- Operating expenses: This ranges from insurance, taxes, maintenance, HOA and bank fees, property management, and repairs.

- Annual debt service: For the purposes of learning how to calculate cash-on-cash return, this number will be your monthly payment to cover both principal and interest related to your loan. This does not include insurance and taxes.

For more property management tips, or to speak with us about the services we can offer you, contact JD Homes today by calling us at (770) 506-2630 or click here to connect with us online.